REPORT 1Q-2024 | Economic and RE data

- Darian RE

- Apr 23, 2024

- 3 min read

Updated: Sep 23, 2025

General Overview

The macroeconomic picture in the first quarter of 2024 remained almost unchanged compared to the end of 2023.

Major global conflicts continue without signs of slowing down, while inflation rates have maintained the trend from late 2023, marking a stabilization at levels still far from the ideal 2%. Economies thus demonstrate significant resistance to interest rate hikes, prompting central banks to postpone their downward adjustments.

Some Numbers

In Italy, the inflation rate in February stood at 0.75% and is revised slightly upward (preliminary estimate 1.26%) for March. The figure for the United States speaks of inflation still close to 3.5%, a factor that, as mentioned, has led the FED to take a more defensive position compared to the counterattack launched at the end of 2023 when it had announced a 75 bps interest rate cut during the current year. As for the United Kingdom, the inflation rate recorded in February dropped to the lowest since September 2021, settling at 3.4% from January's 4%.

In terms of economic growth, official data for 2023 show a GDP increase of 0.9%, while estimates for 2024 stop at +1.0% for the Italian government and +0.6% according to the studies of the Bank of Italy; however, this is higher than what is expected for the average of Eurozone. Furthermore, a considerable decrease in the inflation rate is predicted for 2024, which should settle at 1.3%. The effects of the cut in housing-related bonuses imposed by the government will require special attention.

The United States reported a 2.5% GDP increase for 2023; the Eurozone's figure was 0.4%, while the United Kingdom recorded a contraction of 0.2%.

The Real Estate Market

Analysis of data in the fourth quarter of 2023 confirms the year-on-year trend shown throughout the period: a generalized decrease in the number of residential real estate transactions and more enigmatic figures for commercial real estate transactions, for which the national data is positive, unlike the regional and Milanese area data.

Residential sales decreased 9.7% nationwide, 8.9% in Lombardy, and 10.5% in the metropolitan area of Milan compared to 2022. Even the data comparing the individual closing quarters of the two years shows a trend in line with these figures.

The relatively sharp decline is due to the decrease in mortgage sales, an inevitable result of the policy of increasing interest rates.

On the other hand, the number of transactions for non-residential properties (offices, banks, shops, shopping centers, hotels, and productive properties) showed a slight increase of 1.8% nationally, -3.2% regionally, and a much more pronounced contraction in Milan and its province (-9.7%).

However, data between the last two quarters of 2023 and 2022 show growth in all three cases. The national market had a more linear trend since Milan and Lombardy recorded significant contingent declines in each quarter. Although, indeed, the last quarter of the year is often the most active for both the residential and commercial real estate markets, comparing the last quarters of recent years could reveal something reassuring.

The response will come in the coming months, although the first data of 2024 should confirm the slowdown, at least for the residential market. The 2023 Mortgage Report by the Agenzia delle Entrate, which examines the 2022 market, shows a 4% decrease in mortgage deeds.

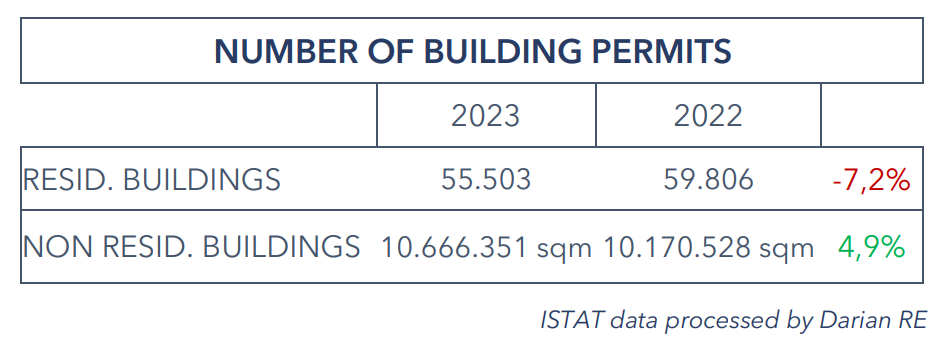

The number of building permits confirms the same trend as the number of transactions: a decrease for residential buildings (-7.2% in 2023 compared to 2022) and an increase for non-residential ones (+4.9% in 2023).

The decree law that halted the tax incentives for construction introduced after the pandemic to boost the economy could significantly impact these figures.

Data Sources: Agenzia delle Entrate, ISTAT, and tradingeconomics.com

Data Processing: Darian RE

"We are experts in different real estate markets and property and asset management. Contact us to help you manage your real estate portfolio or for consultancy."

Comments